Which broker is best for forex trading in India for 2024

Searching for the top forex dealer in India? Based on our arms-on analysis, we’ve diagnosed the These exceptional alternatives tailored to numerous trading wishes. Practical pointers from our specialists are covered.

List of Top Forex Brokers & Trading Platforms in India

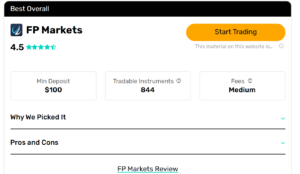

FP Markets – Best Overall

Multiple INR deposit alternatives. Competitive buying and selling fees. 3 buying and selling structures. 24/7 customer service.

OCTA – Best Forex Trading App

Beginner-pleasant OctaTrader app. Dedicated copy trading cell app. MT4, MT5, Autochartist. Competitive spreads. No state of no activity and change fees.

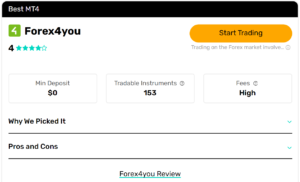

Forex4you – Best MT4

MT4, MT5, Autochartist. 6 account kinds. High leverage. Trading school.

FXTM – Best for Professional Traders

Multiple account sorts. Additional MT4 signs. FXTM Invest for strategy managers. High leverage.

The Forex market Trading in India

In the search for the best forex broker for trading in India, it’s miles best to paste to highly regulated and authorized brokers. Currently, the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have yet to create a framework for licensing or regulating forex agents and feature applied several restrictions on currency exchange.

This is why neighborhood traders in India frequently engage with foreign, regulated brokers that be given customers from India and are supervised through foreign economic authorities, presenting a more at ease and more secure buying and selling surroundings. However, it’s important to be aware that not all foreign agents are regulated equally.

How Did FX Empire Selects the Bests Brokers in India?

- We analyzed if the broker permits deposits and withdrawals in Indian Rupee (INR).

- We opened a stay buying and selling account to check for aggressive fees.

- We examined the broking’s buying and selling platform to look if it is easy-to-use and function-wealthy.

- We carried out a stay customer support take a look at and checked the broker offers. Customer support in Hindi and is to be had at some stage in local enterprise hours.

- We identified if there is a localized Indian model of the dealer’s internet site.

This analysis, coupled with my person buying and selling journey, has led to the findings and studies offered beneath. They highlight the great forex agents in India throughout various categories, tailored to your unique buying and selling wishes.

Now allow’s dive into the selected agents.

How to Choose the Best the Forex market Broker in India?

Choosing the right broking for trading the foreign exchange market may be pretty daunting, particularly considering the multitude of options available. It’s vital to decide that aligns along with your trading desires as each dealer offers a one-of-a-kind range of services, gear, and fees. In India, this decision will become more great because of the u . S .’s regulatory surroundings and distinct marketplace dynamics.

How to choose a secure Forex dealer in India?

Trading the forex marketplace in India is a gray vicinity. The Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have now not certified or regulated foreign exchange trading inside the u . S . A .. This is why buyers in India will alternate with a overseas broker that accepts residents from the united states of america.

This approach that when deciding on a foreign broker to alternate with, you want to test their licenses and rules. However, it’s vital to note that not all regulators are created equal. At FX Empire, we classify them into 3 tiers:

- Tier-1 regulators are based totally in nicely-identified monetary jurisdictions, consisting of the United Kingdom FCA, CySEC, and ASIC.

- Tier-2 regulators are positioned in strong but lesser-regarded monetary jurisdictions, inclusive of the FMA of New Zealand or FSCA South Africa.

- Tier-3 regulators are commonly situated in offshore jurisdictions and consist of the FSC BVI, FSC Mauritius, the SCB, and others.

- Unregulated agents are primarily based in places that do not require any oversight of their actions.

Brokers licenced by means of Tier-1 regulators offer the very best level of investor safety. The UK FCA, CySEC, and ASIC implement felony necessities to segregate customer funds from company price range and provide bad balance safety to ensure your account does no longer fall beneath zero.

I would advise staying clean of unregulated brokers because there’s no legal recourse if case the dealer acts fraudulently and takes your capital. You can test the regulatory repute of a dealer by means of reading the terms and conditions cautiously and looking the online sign in of a economic regulator. You can also find a comprehensive list of dependable brokers by way of jurisdiction here.

Which Apps Are best For Forex Trading ?

These are some best Apps : Which Recommended By NSES,s Also

1-

2-

3-

How Much fess must you expect with a the Forex market broking in India?

In India, foreign exchange agents typically rate expenses in three foremost methods: spreads, commissions, and overnight or swap expenses. Understanding those expenses is crucial to coping with your buying and selling fees and maximizing your ability income.

- Spreads: The spread is largely the difference among the purchase and sell fee of a currency pair. It’s how most brokers make their cash. For example, if the purchase fee (ask) for a forex pair is 1.2000 and the promote price (bid) is 1.1990, the unfold is 10 pips. Brokers offering decrease spreads are typically greater price-effective, but it’s crucial to check in the event that they rate commissions, that could offset the advantages of low spreads. Check out our targeted manual for the fine forex agents with lowest spreads.

- Commissions: Some agents fee a commission on trades, which is mostly a fixed price consistent with trade or a percentage of the trade volume. For example, a broking might fee a $3 commission in keeping with exchange for every one hundred,000 units of foreign money traded or 0.05% of the alternate extent. Commissions can add up, in particular for high-quantity investors, so it’s essential to factor them into your price calculations.

- Overnight/Swap Fees: These are Some fees Which Has Been charged for positions held open overnight. The forex market operates 24 hours a day. At the stop of each buying and selling day, any positions left open incur an hobby adjustment depending at the hobby price differential between the 2 currencies in the pair. Some brokers will offer an Islamic swap-free account so there are no overnight prices, however a better commission in advance to align with Sharia Law. Read extra about high-quality brokers with low swap expenses.

In addition to those, there might be other non-trading costs like deposit and withdrawal, inaction, or account maintenance charges. It’s important to read the dealer’s fees cautiously to understand all of the fees involved.

How to pick out the high-quality Forex account in India?

Your account kind can make or destroy your adventure. Here’s how to choose a trading account wisely in case you are from India:

- Self-Assessment: Start via figuring out your buying and selling aspirations, hazard urge for food, and proficiency degree. Are you a beginner dipping your toes into the forex waters, or a seasoned trader seeking advanced equipment and excessive leverage? Your desires dictate your best account features.

- Account Varieties: Brokers provide a spectrum of debts. Micro or mini debts, with their low deposit necessities and reduced chance exposure, are best for novices. Experienced traders may choose widespread or VIP accounts, imparting larger contract sizes and additional perks.

- Initial Deposit: Consider the account’s minimal deposit. Some call for a larger initial investment than others. Make certain it’s an quantity you’re comfortable committing.

- Leverage & Spreads: Examine the provided leverage and spreads. High leverage can amplify your function, however keep in mind that it’s a double-edged sword, as it is able to growth each capacity profits and risks. Lower spreads equate to decrease buying and selling prices.

- Demo Account: These accounts allow you to exchange with virtual cash, providing a risk-free surroundings to get acquainted with the platform and test techniques. See our list of the quality foreign exchange demo money owed.

How to choose the greatest leverage for forex trading in India?

Leverage allows you to manipulate large positions with a smaller deposit. It’s a device that can extensively make bigger your income as well as your losses.

Tier-1 regulators, consisting of the UK FCA, CySEC, and ASIC, impose a 1:30 leverage limit for foreign exchange buying and selling. This manner you could control a function size of $three hundred with just $10 on your account. However, it’s essential to understand that higher leverage increases risk, as it is able to result in substantial losses if the market moves unfavorably towards your position.

Many offshore and unregulated brokers generally tend to put it on the market very excessive leverage. Exercise warning in those situations. After all, the regulations on leverage set with the aid of Tier 1 regulators are there for a cause: to promote secure and accountable trading amongst retail investors.

What is the great buying and selling platform to use in India?

If you’re geared up to start trading Forex in India, you’ll need a trading platform. But what elements have to you do not forget when making this choice?

In India, MetaTrader four (MT4) MetaTrader five (MT5), and cTrader are seemed because the high-quality alternatives because of their consumer-friendly interfaces, complete toolsets, and verified reliability.

Read extra approximately the platforms in our distinct courses on the quality MT4 agents, excellent MT5 brokers, and satisfactory cTrader brokers.

Some brokers might also provide their very own proprietary trading platforms which they have invested in building. It’s also well worth testing these structures to look which ones align with your buying and selling style. Here are some factors Please to don’t forget:

User-Friendliness: Usability is important. The platform must be easy to apply and apprehend, simple to navigate, and no longer require a steep gaining knowledge of curve. Your consciousness ought to be on buying and selling, not grappling with a complicated interface.

Tools & Indicators: A robust platform functions superior charting equipment and a plethora of technical signs. These resources can resource in reading market developments and making informed buying and selling selections.

Reliability: The platform’s stability is essential. It have to offer seamless, uninterrupted get entry to to the forex marketplace, ensuring you by no means miss a potentially worthwhile exchange.

Explore our listing of Best forex buying and selling systems.

What to keep away & Avoid from while choosing a forex broker in India?

Here are some matters to keep away from while choosing a foreign exchange broking in India:

- Unregulated brokers. If they take your money or act fraudulently there’s no recourse with a purpose to reclaim it.

- Lack of transparency. If a broker’s buying and selling, deposit, or withdrawal fees are too hard to discover, recollect it a crimson flag for insufficient transparency.

- No stay customer service. If a broking does no longer provide access to live customer support through internet chat, smartphone, or social media, then there’s no person to help you in case of any issues, that’s far from perfect.

- Beware of unrealistic profit promises, and constantly conduct your very own due diligence earlier than deciding on a dealer.

How to avoid foreign exchange and CFD scams in India?

Forex and CFD scams can pose sizeable risks for traders in India, largely due to the fact the government has yet to modify these sports. Here are some strategies to help you avoid foreign exchange and CFD scam agents.

- Check the dealer’s law and license. This can be done via checking the regulator’s online check in inside the united states of america wherein the broking operates.

- Confirm the broker’s bodily address and customer service. The broker need to have a physical cope with in a well-known u . S . And a stay customer support group you could touch.

- Do an internet seek. Look up the dealer to test if there are any news articles discussing ability problems with the broking.

- Only use well-known price alternatives which might be secure and relaxed.

- Always check the broker’s terms and conditions.

Our Methodology

Since pioneering the dealer review enterprise, FX Empire’s methodology now encompasses more than 250 records points throughout nine categories. These consist of:

- Trust

- Fees

- Platforms and tools

- Tradable gadgets

- Customer service

- Deposit and withdrawals

- Account types

- Research

- Education

For selecting the best forex brokers in India, our team has leveraged the insights from this research, in addition to considering the following localized factors:

- Availability of Indian payment solutions in INR

- Availability of INR currency pairs for trading

- Acceptance of Indian residents

FAQ

Is the Forex market trading felony in India?

Yes, buying and selling bodily currencies is prison in India however best in case you use an RBI-approved broking and most effective if buying and selling in INR, amongst different regulations – otherwise, it’s far illegal. However, for buying and selling foreign exchange CFDs, the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI) have now not established a regulatory framework. That’s why Indian forex traders inquisitive about trading CFDs normally opt for a overseas dealer.

What is SEBI?

SEBI represents the Protections and Trade Leading body of India.. It is the regulatory frame for the securities marketplace in India, much like the Securities and Exchange Commission within the United States.

Can I change with non-SEBI-regulated brokers in India?

Yes, you may exchange with non-SEBI-regulated agents. However, it’s crucial to make certain that the broking is regulated in their place, which must be a well-known financial middle.

How can I confirm if a Forex broker is regulated in India?

You can confirm if a the Forex market dealer is controlled in India by checking the posting of SEBI-managed specialists on the SEBI web webpage.

What do I want so that you can open a the Forex market buying and selling account in India?

To create a the Forex market buying and selling account in India, you’ll be required to publish a few documents as evidence of identity, including a passport or Aadhaar card. Additionally, you may need to offer proof of your address and offer information of your financial institution account. It may also be important to present evidence of your earnings, such, as a income slip or Income Tax Return (ITR).

Which dealer is suitable for beginners in India?

For beginners in India, FP Markets is a broking worth thinking about because of its wide range of newbie-pleasant account sorts, systems, INR deposit and withdrawal methods, in addition to academic substances.

YOU MAY ALSO LIKE : How to find best stocks for swing trading