Welcome to CNNmoneey! – People use Google to search for the LIC share price target. Today we will tell you what LIC Ltd.’s share price target will be in 2024, 2025, 2027, to 2030.

If you are looking for which share will be best for investment in recent times, then you LIC should know about the LIC Share price target. In this article, we will explain the LIC price target 2025 to LIC share price target 2030. If you are considering whether you should invest in LIC or not,. Then you are in the right place. In this post, you will get a complete analysis of the LIC share price target for 2025, 2026, 2027, 2028, 2029, 2030.

People search on Google to get LIC share price target 2025 to 2030. In this article, we have given information about the company’s financial position, market trends, and some financial factors that will help to check LIC Ltd’s share price target in the coming years. Let us know about the possible LIC share price target of this famous company (LIC) from 2024 to 2025 to the LIC share price target 2030.

About LIC Company

Life Insurance Corporation of India (LIC) is the biggest insurance provider in India, has been a major player in the industry for more than 60 years. Since its founding in 1956, LIC has offered a broad range of insurance services and products to both people and companies all throughout the nation.

- Industry- Insurance (Life)

- ISIN- INE0J1Y01017

- BSE Code- 543526

- NSE Code- LICI

Overview of LIC Company

LIC is renowned for its solid financial standing, dependability, and customer-focused philosophy. To meet the varied needs of its clients, it provides a range of insurance plans, including health insurance, endowment plans, pension plans, and term insurance.

The organization is easily available to customers in both urban and rural locations due to its extensive network of branches and agents. Because of its dedication to providing excellent customer service and satisfaction, LIC has developed a devoted clientele and a solid reputation as a reliable and trustworthy insurance provider. To sum up, LIC is a well-known insurance provider in India that has been providing excellent and committed client service for years. Because of its solid financial status, extensive product offering, and approachable customer service, it is the company that insurance seekers prefer.

| Company Name | Life Insurance Corporation of India (LIC) |

| Established | 1956 |

| Market Cap | ₹ 6,19,280.52 Cr. |

| Book Value | 98.10 |

| Face Value | ₹ 10 |

| 52 Week High | ₹ 1,175 |

| 52 Week Low | ₹ 549.10 |

| P/B | 8.76 |

| DIV. YIELD | 0.31 % |

LIC was established in Kolkata in 1818 by Bipin Das Gupta. With time, LIC has broadened the scope of its offerings to encompass an extensive assortment of insurance products, including pension policies, endowment plans, and term insurance. Additionally, the business has led the charge in educating the Indian populace about financial literacy and the value of insurance.

LIC has established a solid reputation as a dependable and trustworthy insurance provider thanks to its dedication to both financial stability and client care. LIC remains a mainstay of the Indian insurance sector, with a robust presence in both urban and rural areas.

Financial Data Analysis Of LIC Company

Before investing any shares, anyone wants to see the company’s performance, overall profit, and net sales amount. A fundamental understanding of the company’s equity, current ratio, return on assets, and PE ratio is required. The section below talks about the company’s performance. LIC Share Price Target also depended upon the ratio, which is described below.

PE Ratio (Price To Earning Ratio)

The PE ratio is calculated by the market price per share Earning price per share. It means the number of times an investor is ready to pay as compared to earnings time. LIC Ltd. has a PE ratio of 15.35, which is overvalued.

Return on Assets (ROA)

ROA is calculated by Profit After tax ÷ Total Assets. ROA is influenced by 2 factors return on sales and asset turnover. LIC Ltd. Company has a ROA of 1.75%, which is a bad sign for the company’s growth.

Current Ratio

The current ratio is calculated by Current Assets ÷ Current Liabilities. LIC Ltd. has a current ratio of -63.37.

Return On Equity (ROE)

ROE is measured by = Net profit ÷ Average Share holding equity. LIC Ltd. has an ROE of 129.56%, Lower it is not better.

History Of LIC Share Price Target From The Year 2024 to 2030

LIC Share is listed on the BSE (Bombay Stock Exchange) and the NSE (National Stock Exchange). LIC Share is a bullish trend in the share market. The last 6 month’s share growth was +383.80 (63.52%), the last 1 year’s share growth was +437.95 (79.62%), the last 5 year’s share growth was +161.85 (19.59%), and the maximum share growth was +161.85 (19.59%).

LIC Share Price Return amount was last 1 month 11.1%, the last 3 months’ share return was 9.89%, the last 1-year share return was 81.23%, the last 3 years’ share growth was 93.00%, the last 5 year’s return growth was 1033.66%. LIC is dedicated to giving its policyholders financial stability and places a high priority on offering excellent customer service. Additionally, the business is crucial in raising public awareness and financial literacy.

Share Price Target 2024

All things considered, LIC is a major player in the Indian insurance market, offering families and individuals peace of mind and financial stability. When it comes to insurance and financial solutions, many people choose it because of its long-standing reputation and dedication to excellence.

The outlook for the share price of LIC in 2024 is significantly shaped by market trends, economic factors, corporate performance, and regulatory changes. To determine LIC’s target share price for the upcoming year, analysts will carefully examine financial statements, macroeconomic statistics, and industry developments. The pursuit of deciphering the workings of the market and projecting the 2024 share price objective for LIC will no doubt remain a captivating pursuit for analysts and investors alike as we approach the start of a new year. One thing is clear in this always changing world of investing and finance: breaking through the market’s mysteries and finding the right path to financial success will require a relentless quest of information and insight.

| Year | LIC share price target 2024 |

| 1- (LIC share price target 2024) | ₹915.96 |

| 2- (LIC share price target 2024) | ₹1010.62 |

The total revenue amount of the company was ₹ 722,304.89 Cr. in March 2022 which became ₹ 790,245.56 Cr. in March 2023. The net revenue from operation was ₹721,645.23 Crore in March 2022 which became ₹791,689.89 Crore. If we look at the share price forecast of LIC Share Price Target 2024, the 1st Price Target is ₹915.96 and the 2nd Price Target is ₹1010.62.

Share Price Target 2025

The LIC’s function as a business goes beyond merely offering insurance services. It is also very important in raising public awareness and financial literacy. LIC wants to enable people to make educated decisions about their financial future by running a number of campaigns and educational programs.

To sum up, the LIC share price 2025 goal for LIC appears optimistic; nonetheless, investors should use caution and diligence while making their purchases. Investing can be successful in the changing market environment if one stays educated and makes wise selections. Before making any investment decisions, investors are urged to carry out extensive research and take their own risk tolerance into account. In the years to future, investing in LIC can prove to be a profitable proposition with proper planning and a long-term outlook. The stock price may be driven by external events and market conditions, but LIC is confident in its ability to provide value to its shareholders.

| Year | LIC share price target 2025 |

| 1- (LIC share price target 2025) | ₹1023.13 |

| 2- (LIC share price target 2025) | ₹1136.30 |

The total revenue amount of the company was ₹ 722,304.89 Cr. in March 2022 which became ₹ 790,245.56 Cr. in March 2023. The net revenue from operation was ₹721,645.23 Crore in March 2022 which became ₹791,689.89 Crore. If we look at the share price forecast of LIC Share Price Target 2025, the 1st Price Target is ₹1023.13 and the 2nd Price Target is ₹1136.30.

Share Price Target 2027

LIC is easily available to customers due to its extensive nationwide network of branches and agents. In addition to its solid financial history, the organization is reputable for providing dependable services.

In the insurance industry, LIC is a reputable business with government support, which may contribute to its further expansion in the years to come. Furthermore, it is anticipated that the Indian insurance industry would keep growing, offering LIC chances to grow its market share.

According to some projections, LIC shares could witness a large increase in value by 2027, with a projected price range of Rs. 1,500 to Rs. 2,000 per share. It’s crucial to remember that these are only estimates, and that actual costs could change depending on the state of the market and the success of the business.

| Year | LIC share price target 2027 |

| 1- (LIC share price target 2027) | ₹1198.80 |

| 2- (LIC share price target 2027) | ₹1259.87 |

Overall, the company’s solid market position and development potential indicate that investing in LIC shares could be a lucrative opportunity for long-term investors, even though the precise share price goal for LIC in 2027 is yet unknown. The total revenue amount of the company was ₹ 722,304.89 Cr. in March 2022 which became ₹ 790,245.56 Cr. in March 2023. The net revenue from operation was ₹721,645.23 Crore in March 2022 which became ₹791,689.89 Crore. If we look at the share price forecast of LIC Share Price Target 2027, the 1st Price Target is ₹1198.80 and the 2nd Price Target is ₹1259.87. The stock price may be driven by external events and market conditions, but LIC is confident in its ability to provide value to its shareholders.

Share Price Target 2030

Investors are closely watching the direction of LIC’s share price over the next ten years as we enter a new decade. With a large investor base and a track record of steady expansion, Life Insurance Corporation of India, or LIC, is a major player in the Indian financial sector.

A wide range of estimates can be found for the LIC share price in 2030 due to these factors. Some experts may project a bullish trend, believing that the share price will rise as a result of consistent growth and market domination. Some might adopt a more cautious stance, accounting for any dangers and uncertainty in the market. If investors want to determine a target price for LIC’s shares in 2030, they should do a lot of study, receive advice from experts, and keep up with market trends. In the ever-changing financial landscape, diversification and a long-term investment view can help reduce risks and take advantage of possible opportunities. Investors hoping to reach their financial objectives will need to keep a close check on LIC’s performance and market trends as we traverse the ever-changing world of finance and investments.

| Year | LIC share price target 2030 |

| 1- (LIC share price target 2030) | ₹1273.68 |

| 2- (LIC share price target 2030) | ₹1398.98 |

As we move closer to 2030, keep a close watch on LIC’s share price performance and its ramifications for investors. Stay tuned for updates and insights. The total revenue amount of the company was ₹ 722,304.89 Cr. in March 2022 which became ₹ 790,245.56 Cr. in March 2023. The net revenue from operation was ₹721,645.23 Crore in March 2022 which became ₹791,689.89 Crore. If we look at the share price forecast of LIC Share Price Target 2024, the 1st Price Target is ₹1273.68 and the 2nd Price Target is ₹1398.98. The stock price may be driven by external events and market conditions, but LIC is confident in its ability to provide value to its shareholders.

How To Purchase LIC Share?

The most common trading platform for purchasing the LIC Share is described below.

- Zerodha

- Upstox

- Groww

- Angelone

Peer’s Company of LIC Ltd. Company

- SBI Life Insurance Company Ltd

- HDFC Life Insurance Company Ltd

- ICICI Lombard General Insurance Company Ltd

- ICICI Prudential Life Insurance Company Ltd

- Life Insurance Corporation of India

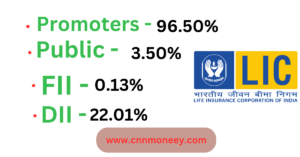

Investors Types And Ratio Of LIC Ltd Company

There are mainly four Types of Investors in LIC Company. The company’s growth also depended upon the ratio of investors who invested in the share.

Promoters Holding

Promoters Holding means how much capital is invested by company promoters (owner of the company) through overall capital. LIC Company’s promoter holding capacity is 96.50%.

Public Holding

Public Investors an individuals who invest in the public market for profit in the future (large and small companies). Company LIC public holding capacity is 3.50%.

FII (Foreign Institutional Investors)

Foreign Institutional Investors are those big companies that invest in different countries company. LIC Company’s FII is 0.13%.

DII (Domestic Institutional Investors)

Domestic Institutional Investors (like Insurance, companies mutual funds) who invest in their own country. LIC Company’s DII is 22.0%.

Advantages and Disadvantages Of LIC Share

Every share has some advantages and some disadvantages, Also. So, the LIC Share Price Target also has some advantages and disadvantages which are described below.

Advantages

- Stable and reliable investment option.

- Potential for dividend income.

- Long-standing reputation in the market.

1 thought on “LIC Share Price Target 2024, 2025, 2026 to 2030”