Today in this article, we are going to predict GTL Infrastructure share price target analysis, We have provided a financial expert share price prediction for upcoming years 2025 to 2040.

Today in this Important article, we have discussed the GTL Infrastructure Limited company in detail about their past and Future growth .

If you are thinking about long term investment and swing trading, then this stock will be best option for you to invest in at this time.

Because this company have given 40.9% profit margin in last 5 years. A GTL company has had strong fundamental growth since their last year growth in terms of revenue & Gross profit.

So today in this important article, I have tried to discuss all important information, such as fundamental analysis, technical aspects, and the future in terms of return. We will discuss it briefly.

GTL Infrastructure Limited Company Full Details

GTL Infrastructure was established on December 23, 1987, as a private limited company. It’s headquarters are situated in Mumbai. In present, Manoj Tirodkar is the CEO / Chairman of this company.

This company is a major player in providing network service to telecom operators. This Company is ISO Certified 14001:2004 and ISO 9001:2000 for Network Providing Services.

The company’s Main Work is to provide network Services to telecom companies. They help improve network facilities across 46 countries around the world.

| GTL Infrastructure Limited | Established on 1987 |

| Headquarter | Mumbai |

| Founder | Manoj G. Tirodkar |

| Market Cap | ₹ 240 Cr. |

| P/E Ratio | 1.9 |

| Industry P/E | –2.15 |

| Debt to equity | -76.7% |

| P/B | 0 |

| EPS (TTM) | ₹ 13.91 |

| Face Value | ₹ 10.0 |

| 52-Week High | ₹ 19.70 |

| 52-Week Low | ₹ 6.85 |

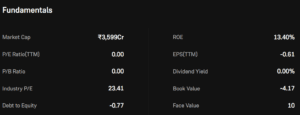

GTL Infrastructure Limited Company Fundamental Analysis

If you are finding the best stock for long-term investment, we must do a fundamental analysis because, in fundamental investment, we know about the future growth of the company that you are looking for.

If you are seeing, the market cap of this company at present time is up to 67,788 crore, and their P/E ratio is 31.23, with a ROE of 12.58%.

By this picture, You can see the company has strong Fundamental For this they are Providing high return from past few months.

GTL Infrastructure Limited Company Share for Swing Trading

If you are looking to invest or do swing trading this month on this company, then this time it will be beneficial for you for long-term investment .

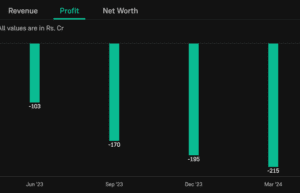

because this company has reduced their loss from the last 3 months, which is up to 150%. This company is situated in the highest zone, where they can breakout and give the best target a few times.

If you are doing a swing trade on this company, then your open target will be at ₹19.70 and your close target will be at ₹25.70.

You can see by this Picture Company what type of return they are giving from last past 3 months This time will be best for swing trading.

Overall Price Prediction Table

| Year | Open Price (₹) | Close Price (₹) |

| 2024 | 19.70 | 21.89 |

| 2025 | 22.39 | 23.67 |

| 2026 | 24.35 | 25.87 |

| 2027 | 26.39 | 28.35 |

| 2028 | 29.20 | 30.78 |

| 2029 | 30.55 | 31.12 |

| 2030 | 31.85 | 32.48 |

| 2040 | 33.12 | 34.39 |

GTL Infrastructure Share Price Target 2024: ₹19.70

| Year | Open Price (₹) | Close Price (₹) |

| 2024 | 19.70 | 21.89 |

The stock price of GTL Infrastructure may vary. GTL Infrastructure share price target 2024 is ₹19.70. If GTL can cross this Price target in their half month So they can achieve their second target ₹21.89.

Read More: LIC Share Price Target 2024, 2025, 2026 to 2030

GTL Infrastructure Share Price Target 2025: ₹24.35

| Year | Open Price (₹) | Close Price (₹) |

| 2025 | 22.39 | 23.67 |

In our Research team have predicted The GTL Infrastructure share price target in 2025 is ₹22.39 and after they may should at a Price cap of ₹23.67

GTL Infrastructure Share Price Target 2026: ₹24.35

| Year | Open Price (₹) | Close Price (₹) |

| 2026 | 24.35 | 25.87 |

According to technical data the GTL Infrastructure share price in 2026 may vary at ₹24.78, and in completing half cycle it may hit their second target ₹24.80.

GTL Infrastructure Share Price Target 2027: ₹26.39

| Year | Open Price (₹) | Close Price (₹) |

| 2027 | 26.39 | 28.35 |

In our Research If valuation of GTL Infrastructure decreased And they focused on their initial so, The GTL Infrastructure share price target in 2027 may at ₹26.39, and after it’s completing their Q2(2024-25) it may achieve at ₹28.35.

GTL Infrastructure Share Price Target 2028: ₹29.20

| Year | Open Price (₹) | Close Price (₹) |

| 2028 | 29.20 | 30.78 |

By the market Movement of GTL Infrastructure in 2024 by seeing their profit it may be seen . The GTL Infrastructure Share price target in 2028 is ₹29.80. By the end of their Q2 results they can achieve it’s initial target of ₹ 29.23.

Read More: Adani Power Share Price Target 2025, 2026, 2027, 2030, 2035, 2040, 2045, 2050 (Long-Term)

GTL Infrastructure Share Price Target 2029: ₹30.55

| Year | Open Price (₹) | Close Price (₹) |

| 2029 | 30.55 | 31.12 |

The Stock prediction may vary But in the year of 2029, GTL Infrastructure may hit their Peak Strength because it have potential to achieve. The GTL Infrastructure Share Price target for 2029 is at ₹30.60After achieving this, they can hit their second target ₹31.12.

Read More: Himadri Share Price Target 2025, 2026, 2027, 2028, 2030, 2032, 2035

GTL Infrastructure Share Price Target 2030: ₹31.85

| Year | Open Price (₹) | Close Price (₹) |

| 2030 | 31.85 | 32.48 |

This may be the peak year for GTL Infrastructure because we can see boom growth in their shares price. The GTL Infrastructure Share price target in 2030 is ₹31.85; after their q2 result they have potentials to hit their second Target of ₹32.48.

GTL Infrastructure Share Price Target 2040: ₹33.12

| Year | Open Price (₹) | Close Price (₹) |

| 2040 | 33.12 | 34.39 |

The Stock price of GTL Infrastructure may Vary. GTL Infrastructure Share Price Target For 2040 is ₹33.12. If GTL Infrastructure Can Cross This Price target in their half month So they can Achieved there Second target Of ₹34.39.

Read More: Inox Green Share Price Target 2024,2025,2027,2030,2035,2040,2050 | Buy or Not ?

Should I buy GTL Infrastructure Limited stock?

Before investing in GTL Infrastructure stock, we have to analyze market dynamics, financial performance, and past returns in last 6 months.

Expert Forecasts on the Future of GTL Infrastructure Limited stock

Analysts are bullish on GTL infrastructure prospects because this company has given higher returns in a short time. Experts are assuming a big zone where the market can give a high profit to swing traders and to those who see this company as having a higher profit.

Conclusion

In this article, we have predicted GTL Infrastructure share price target 2024, 2025, 2026, 2027, 2028, 2029, 2030, 2040. Before investing in this, you should check the current financial report because we update our content twice a month.

FAQs

[sp_easyaccordion id=”1980″]