This article will provide you with a projection for the Delhivery Share Price Target: for the end of the current year as well as the following ones: 2025, 2027, 2030, and 2035. Delhivery Share Price Target: 2024, 2025, 2027, 2030, 2035 (Long-Term)

You should have a better understanding of Delhivery and the anticipated share price objective by the end of this article. Using our methodology, we will determine if the stock is a good long-term investment or not.

Delhivery Overview:

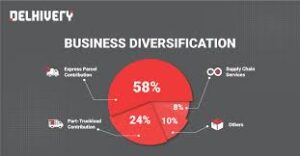

Delhivery is a supply chain and logistics company based in India. headquartered in Gurugram. Sahil Barua, Mohit Tandon, Bhavesh Manglani, Suraj Saharan, and Kapil Bharati created it in 2011. Delivery, express mail, supply chain management, third-party logistics, truckload shipping, partial truckload shipping, and freight forwarding are among the services provided by Delhivery. To learn more, visit their official website using the table below.

| Name | Delhivery Ltd |

| Industry | Logistics |

| Founded | 2011 |

| Services | Delivery, express mail, third-party logistics, supply chain management, truckload shipping, partial truckload shipping, freight forwarding |

| Country | India |

| Website | delhivery.com |

| Profile | Delhivery |

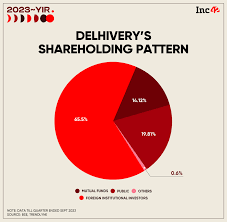

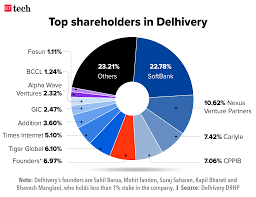

Shareholding Pattern in Delhivery:

- Foreign Institutions: 62.71%

- Retail and others. 20.97%

- Mutual Funds: 16.25%

- Other domestic institutions. 0.07%

Fundamentals of Delhivery:

Delhivery has a market value of 348.42 billion. There are 736.39 million outstanding shares. Moreover, profits per share are -₹7.41. You can learn about various topics, including dividend yield, from the table below, which also includes book value, price to book (P/B), and price of earnings ratio (P/E).

| Market cap | 348.42B |

| Enterprise value | ₹333,696,270,336.00 |

| Shares outstanding | 736.39M |

| P/E ratio | – |

| Forward P/E ratio | – |

| Price / Book | 3.82 |

| Book value | ₹123.92 |

| Payout ratio | 0.00% |

| Quick ratio | 2.64 |

| Current ratio | 4.52 |

| Debt / Equity | 10.03 |

| Price / Sales | 4.61 |

| Earnings per share | -₹7.41 |

| Revenue per share | ₹103.54 |

| Total cash per share | ₹31.75 |

| Forward annual dividend rate | – |

| Ex-Dividend date | – |

| Forward annual dividend yield | – |

| Five-Year Average Dividend Yield | – |

| Total cash | 23.34B |

| Total debt | 9.13B |

| Total revenue | 75.55B |

| Return on assets | -4.64% |

| Return on equity | -5.91% |

| Gross profit | – |

| Gross margin | 80.33% |

| held by insiders | 41.81% |

| % Held by Institutions | 38.15% |

Delhivery Share Price NSE/BSE:

The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) both listed Delhivery shares.

As of January 2024, Delhivery shares are trading at about 465.00 INR a share on the NSE. The price of Delhivery shares on the BSE is currently 472.90 INR.

Delhivery IPO Details

| IPO Date | May 11, 2022, to May 13, 2022 |

| Listing Date | May 24, 2022 |

| Face Value | ₹1 per share |

| Price Band | ₹462 to ₹487 per share |

| Lot Size | 30 Shares |

| Total Issue Size | [.] shares (aggregating up to ₹5,235.00 Cr) |

| Fresh Issue | [.] shares (aggregating up to ₹4,000.00 Cr) |

| Offer for Sale | [.] shares of ₹1 (aggregating up to ₹1,235.00 Cr) |

| Employee Discount | Rs 25 per share |

| Issue Type | Book-Built Issue IPO |

| Listing At | BSE, NSE |

Delhivery Share Price History:

| Year | Delhivery | YOY Chg% | ↑High – ↓Low |

|---|---|---|---|

| 2022 | ₹331.45 | – | ↑ ₹708↓ ₹306 |

| 2023 | ₹389.25 | 17.4% | ↑ ₹452↓ ₹291 |

| 2024 | ₹473.15 | 21.5% | ↑ ₹477↓ ₹381 |

Delhivery Expected Share Price Target:

| Year | Share Price Target (Minimum) | Share Price Target (Maximum) |

|---|---|---|

| 2024 | ₹460 | ₹550 |

| 2025 | ₹550 | ₹670 |

| 2026 | ₹670 | ₹780 |

| 2027 | ₹780 | ₹890 |

| 2030 | ₹1100 | ₹1200 |

| 2035 | ₹1600 | ₹1800 |

Delhivery Share Price Target 2024:

Based on the analysis, we will learn the target share price for Delhivery by 2024, as well as the lowest and maximum prices—460 and 550, respectively. The range of amounts is determined by the company’s strategies.

Delhivery Share Price Target 2024 As Follows:

| Year | Target 1 | Target 2 |

| 2024 | 460 | 550 |

Delhivery Share Price Target 2025:

Delhivery’s share price objective for 2025 is predicted to be between 550 and 670 at its lowest and maximum values, respectively.

Delhivery Share Price Target 2025 As Follows:

| Year | Target 1 | Target 2 |

| 2025 | 550 | 670 |

Delhivery Share Price Target 2027:

Delhivery’s share price objective in 2027 is anticipated to be between 780 and 890 at its lowest and greatest values, respectively.

Delhivery Share Price Target 2027 As Follows:

| Year | Target 1 | Target 2 |

| 2027 | 780 | 890 |

Delhivery Share Price Target 2030:

The projected minimum and maximum prices for Delhivery shares in 2030 are 1100 and 1200, respectively.

Delhivery Share Price Target 2030 As Follows:

| Year | Target 1 | Target 2 |

| 2030 | 1100 | 1200 |

Delhivery Share Price Target 2035:

The anticipated price range for Delhivery shares by 2035 is 1600 at the lowest and 1800 at the highest.

Delhivery Share Price Target 2035 As Follows:

| Year | Target 1 | Target 2 |

| 2035 | 1600 | 1800 |

Conclusion:

I hope the Delhivery Share Price Target for 2024–2035 is now clear to you. This is merely a prediction; to gain an understanding, examine the graph.

Disclaimer: Hi everyone, We would like to let you know that SEBI has not given us authorization. Please use the Delhivery share price target for informative and educational purposes only. Only when the market indication is positive will the price forecasts be accurate. It is not advised for anyone to purchase, sell, or keep shares. Before making any investments, investors should conduct their own research or heed the advice of their financial advisors or specialists.

ALSO READ : KPI Green Energy Share Price Target: 2024, 2025, 2026, 2027, 2028, 2035 (Long-Term)